Mutual Funds: Your Next Possible Investment

Presented by: Advisor, Maggie Johndrow

Co-authored by: Intern, Evelyne Beaule

Why buy one piece of candy when you could buy a variety pack with all your favorites? Believe it or not, this is the exact concept of mutual funds, a very popular investment strategy.

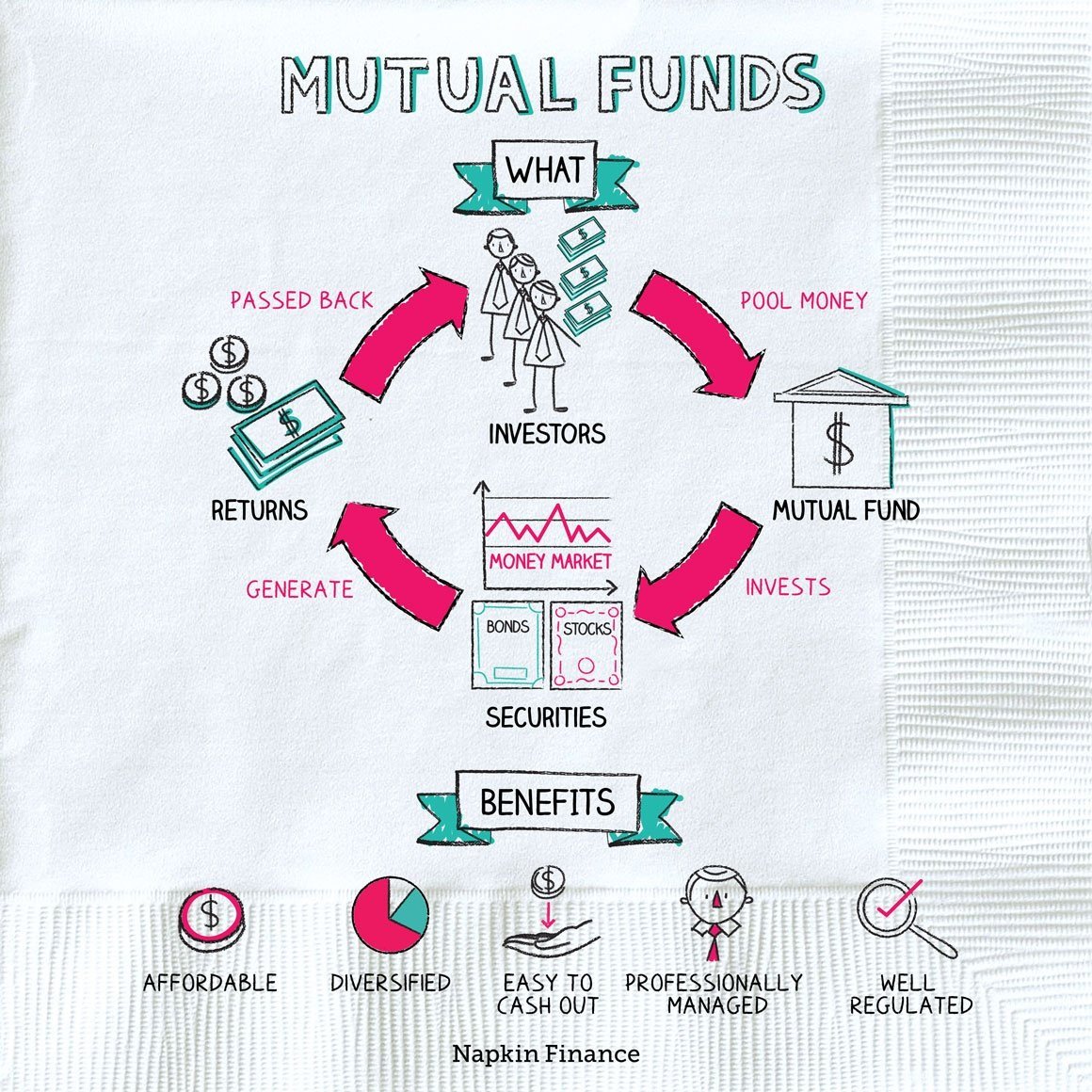

To start, what are mutual funds? Mutual funds are a “hands-off” way to invest in assets and gain exposure to hundreds of stocks, bonds, and other investments. Using a mutual fund allows an investor to pool a mix of assets and invest in various companies and industries, within a single mutual fund. In simple terms, you are distributing your money across multiple investments. If one of the underlying companies held in the mutual fund fails, you are less likely to lose your entire investment as you are invested in many other companies also held in the mutual fund.

There are four main reasons why mutual funds may be a wise investment choice: diversification, affordability, simplicity, and professional management.

1.Diversification

Mutual funds are an efficient way to diversify your portfolio by providing access to a range of companies and industries without having to select individual stocks or bonds one by one. Instead, by purchasing one –or many– mutual funds, you are investing in many stocks or bonds across the entire fund.

2.Affordability

Going back to the candy analogy, which is cheaper: buying ten candy bars separately or buying a pack of ten candy bars all at once? It’s the same idea for mutual funds. Because mutual funds buy and sell large amounts of securities simultaneously, transaction costs are often lower than paying as an individual investor. Mutual funds also allow you to decide how much you are investing as you only have to meet the minimum investment amount for a mutual fund, and then it is up to you to determine how much more to contribute.

3.Simplicity

Investing in mutual funds is simple and straightforward. Once you purchase a mutual fund, a portfolio manager makes the decisions about the underlying holdings in the fund, not you. If you ever decide to buy or sell a mutual fund, they trade daily.

4.Professional Management

With mutual funds, you also benefit from having a professional manager reviewing and researching the fund’s portfolio on an ongoing basis. Fund managers do all the research for you and select the securities that best fit the mutual fund’s investment mandate and provide ongoing monitoring. With almost 7,500 mutual funds in the United States to choose from, you likely can find one whose mandate matches your personal investment goals.

While investing in a mutual fund doesn’t give you direct ownership of the stocks or other investments within it, you may equally share the profits or losses of the fund’s assets with the other investors in that mutual fund. The fund and its investors may earn income from dividends on stock or interest on bonds, and then the income minus expenses will be paid to shareholders. Mutual fund investors may also make money from capital gain distributions. This means that if the price of securities in a fund increases and then that security is sold, the fund may have a capital gain. These capital gains, minus any capital losses, are then distributed to investors at the end of the year. Investors should remain mindful of such tax consequences.

Now that you have a basic foundation of mutual funds and their benefits, there are two ways to take action and begin investing in mutual funds: buy directly from the company that created the fund, or work with a financial advisor to generate an investment plan for you.

Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the mutual fund, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Johndrow Wealth Management LLC Is located at 2 Bridgewater Rd. Suite 101 Farmington CT 06032 and 1555 Post Road E. Suite 203 Westport, CT and can be reached at 860-470-7424. Securities and advisory services offered through Commonwealth Financial Network®, member FINRA/SIPC, a registered investment adviser. Fixed insurance products and services are separate from and not offered through Commonwealth Financial Network®.

© 2022 Commonwealth Financial Network®

Presented by: Advisor, Maggie Johndrow

Co-authored by: Intern, Evelyne Beaule

Evelyne Beaule is a new part of the Johndrow Wealth Management team with her role being an intern. She is a senior at Miss Porter’s School and is looking forward to attending Connecticut College in the near future. She is interested in behavioral economics and looks to gain experience in the financial world to lead her studies and what she might do in the future.